Smart Lending CRM for Faster Loan Disbursements

A single platform to manage all your teams and workflows—Sales, Call Center, Field Operations, Collections & more.

Trusted by companies across the BFSI space

Which Lending Process Do

You Wish to Manage?

Make Borrowing Easy & Straightforward

for Loan Applicants

User-friendly application forms, automated back-end processing and more

Complete loan inquiry capture

Acquire high-intent borrowers faster than competitors by capturing leads from every channel—digital, calls, email, social media, marketplaces, and more. Automated screening ensures your team focuses only on qualified prospects.

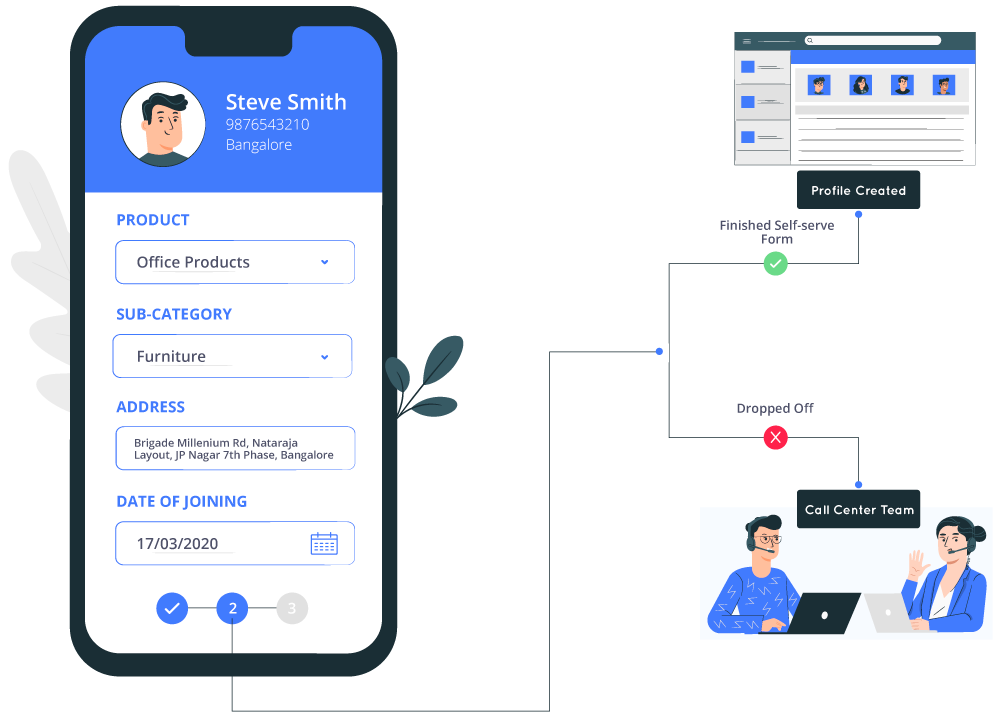

Self-serve application forms

Simple, mobile-friendly application forms deliver a seamless borrower experience. OTP verification filters out non-genuine requests at the first stage, while resume-anytime applications save time for both borrowers and agents.

Self-serve landing portals

Offer dedicated self-service portals for loan applicants and customers. Borrowers can apply with ease, manage profiles and applications, upload documents, track status, and receive real-time verification and approval updates.

End-to-End Loan Workflow Management with Built-in Process Designer

Deliver a smooth, digital-first experience to your teams with automated loan application workflows.

Enhance operational efficiency for pre-screening, sales, and underwriting teams

Preserve your teams’ bandwidth against redundant tasks

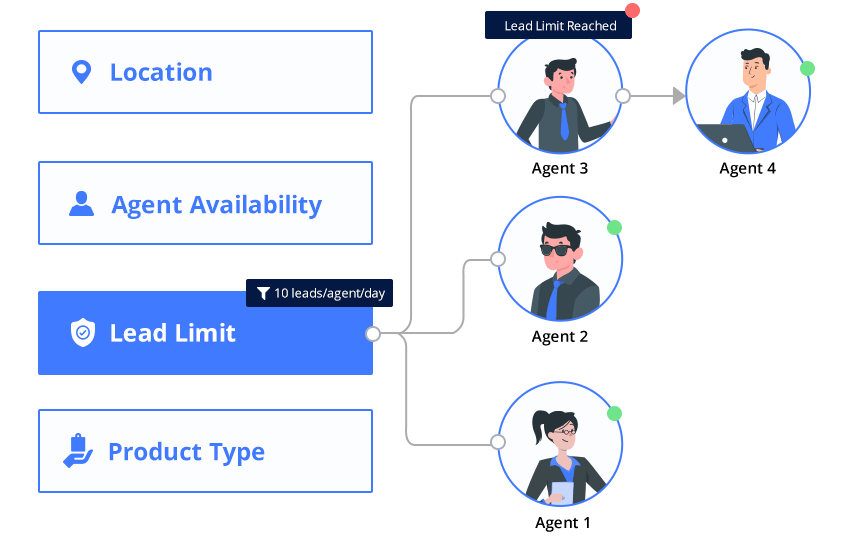

Smart application distribution

Distribute inquiries and applications automatically to your salespeople, underwriters, fraud control, verification & other teams, based on any criteria you want – loan type, location, agent availability, performance, application status and more.

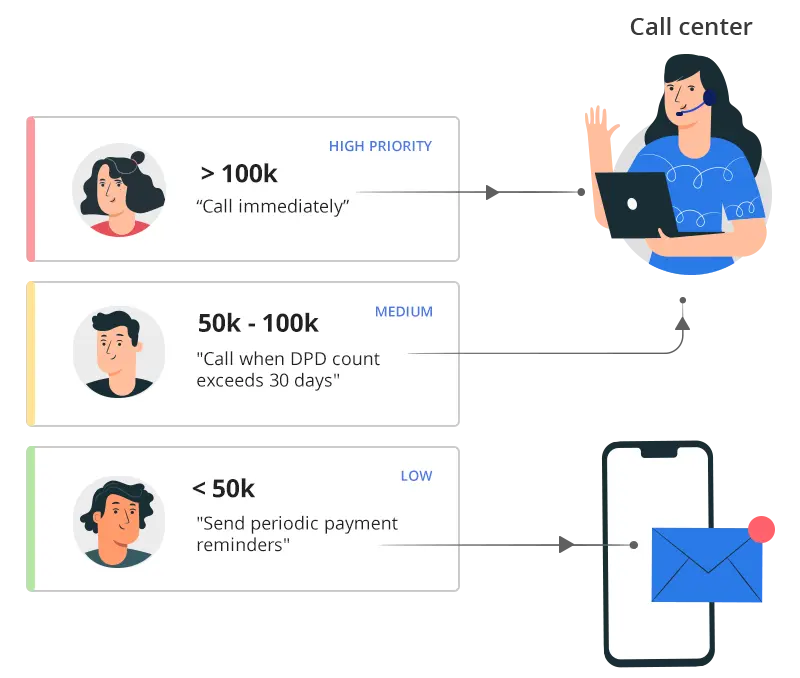

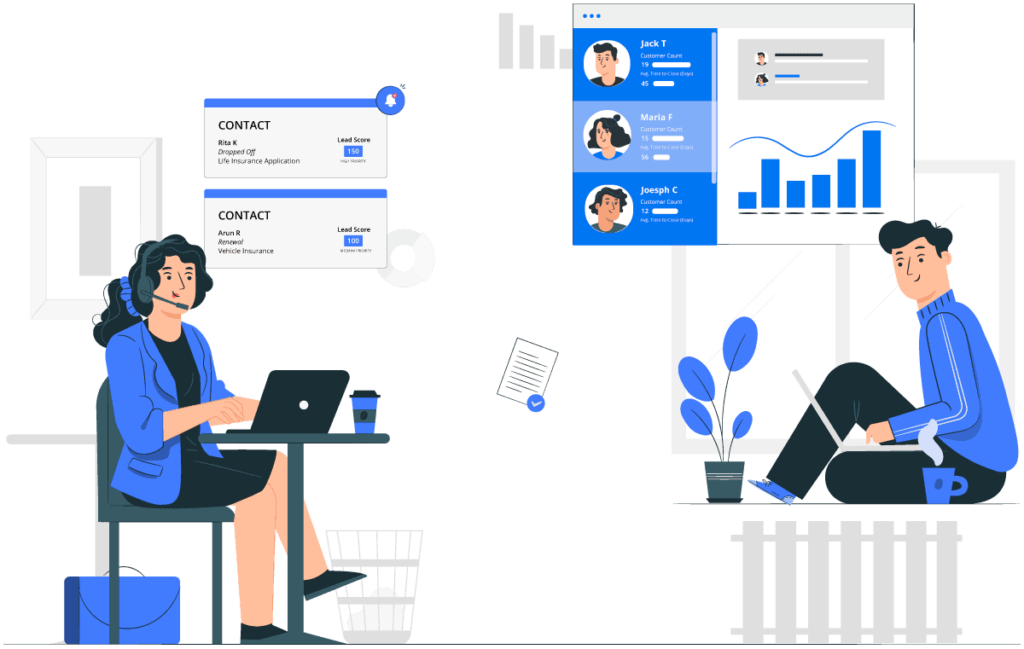

Timely call center intervention

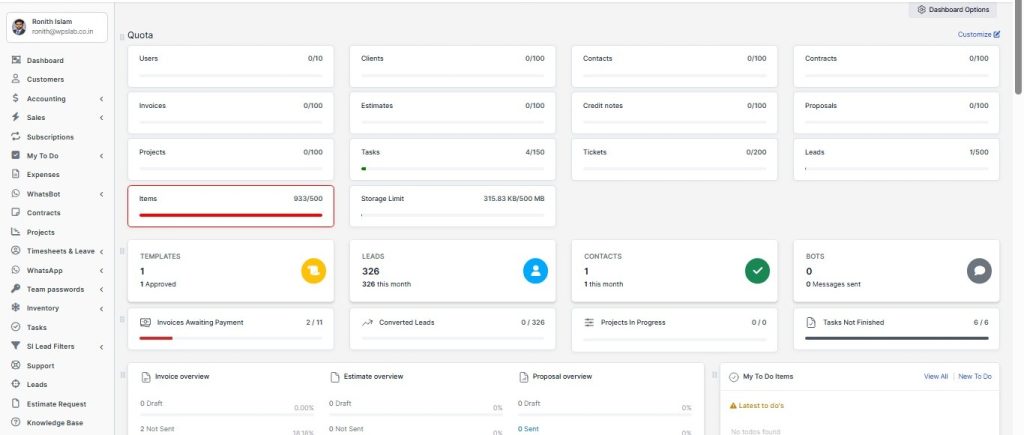

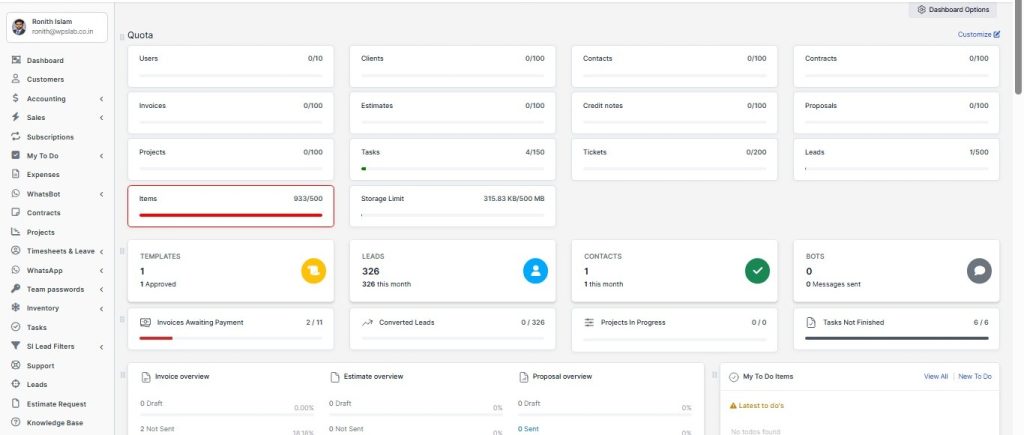

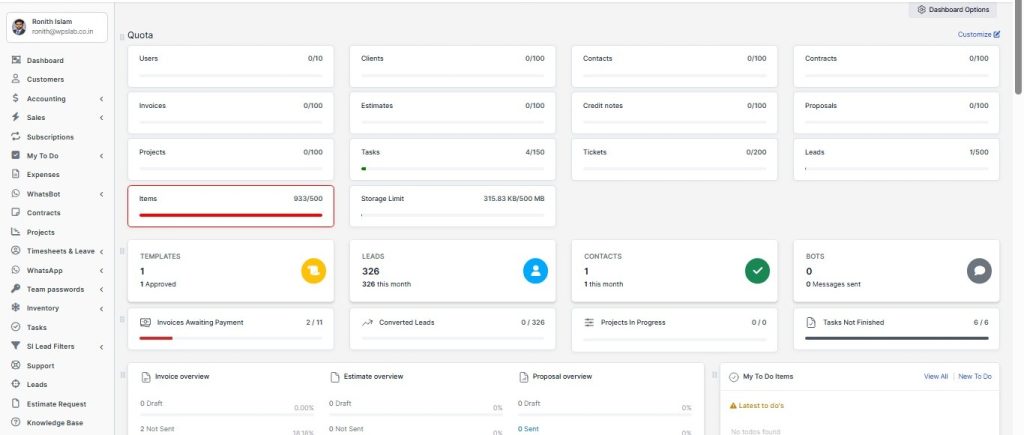

WPSCRM is a smart, all-in-one CRM platform designed to streamline sales, call center, field operations, collections, and customer management through automated workflows and real-time insights.

Dynamic forms for your teams

Dynamic forms adapt to each loan type by showing only the required fields. This keeps applications clutter-free, minimizes manual errors, and helps teams complete applications faster on behalf of borrowers.

Smart, dynamic forms display relevant fields based on the loan application type. This simplifies data entry for teams, reduces mistakes, and accelerates application completion.

Build Lasting Relationships with

Borrowers and Customers

Build engagement workflows to engage and

enroll more borrowers

Smart borrower segmentation + relevant communication

Segment borrowers and customers using multiple criteria such as loan type, application status, demographics, location, financial profile, and credit history to deliver relevant messaging across every communication channel.

Create smart borrower segments based on loan applications, status, demographics, geography, financial standing, and credit data—ensuring consistent, personalized communication at every touchpoint.

Cross-sell opportunity identification

Improve customer lifetime value and borrower retention by identifying timely cross-sell opportunities. For instance, a home loan customer with a strong repayment history visiting a car loan page can be instantly offered a pre-approved auto loan.

Increase long-term customer value by acting on intelligent cross-selling insights—such as offering a pre-approved vehicle loan to a high-credit home loan customer exploring car loans online.

Access borrower info from multiple data points

Leverage pre-built integrations and data exchange APIs to gather all the information required for loan offer creation. Seamlessly access data from LOS, CIBIL, Experian Hunter, Perfios, NetBanking Connect, PDF Statement Analyzer, and more to automate borrower qualification and offer generation.

Use ready integrations and robust APIs to pull borrower data from multiple systems including LOS, CIBIL, Experian Hunter, Perfios, NetBanking Connect, and statement analyzers—enabling automated eligibility checks and instant loan offers.

Offer generation engine

Use attributes such as income, age, CIBIL score, and other key parameters to instantly generate loan offers. These inputs can be provided by users, captured through activity tracking within the CRM, or fetched from third-party systems via APIs—enabling automated approvals or rejections.

Instantly create loan offers using borrower data like income, age, and credit scores. Information can be sourced directly from applicants, tracked through platform activity, or integrated from external tools to automate offer generation or application rejection.

Build a Highly Productive Field Workforce

One mobile app to increase the efficiency of all your feet-on-street teams

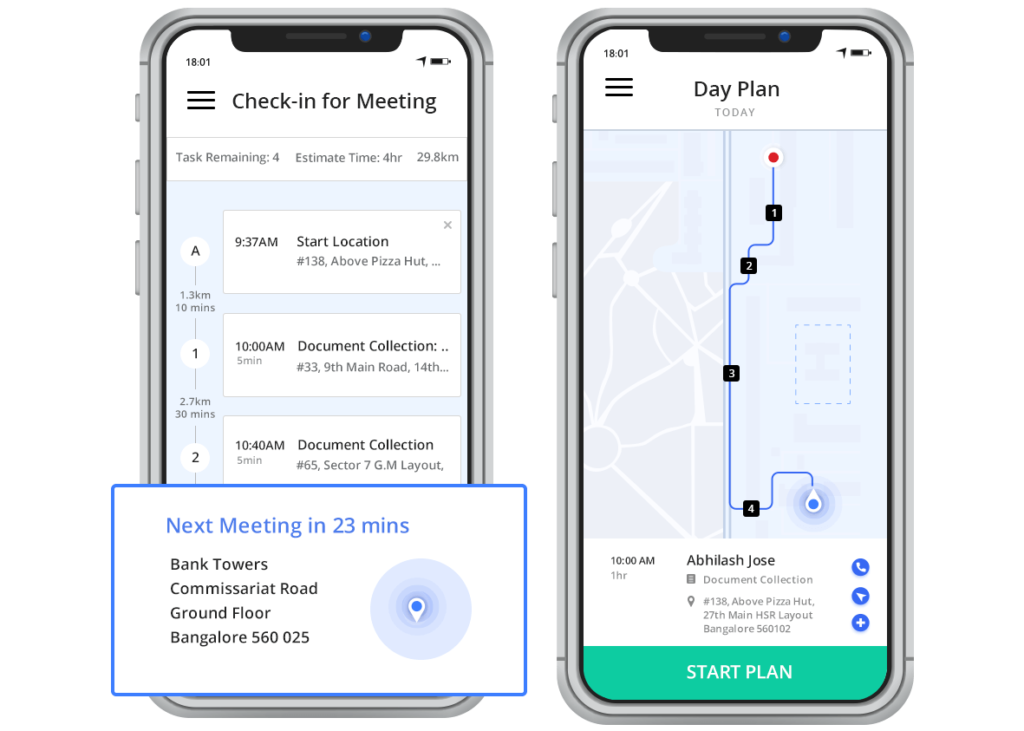

Agents’ daily schedule

WPSCRM intelligently plans your agents’ daily schedules—prioritizing meetings, suggesting optimal routes, setting daily goals, and identifying nearby opportunities to maximize productivity.

With WPSCRM, agents get an auto-planned day that includes high-priority meetings, smart route mapping, and nearby visit suggestions—helping them achieve more with less effort.

Real-time agent tracking

Keep teams accountable with complete activity tracking—automatic check-ins, geo-location validation of meetings, geofencing to prevent misreporting, and full visibility into conversations and actions.

Ensure transparency and accountability with auto check-ins, geo-tracking for meeting verification, geofencing safeguards, and comprehensive tracking of all agent activities.

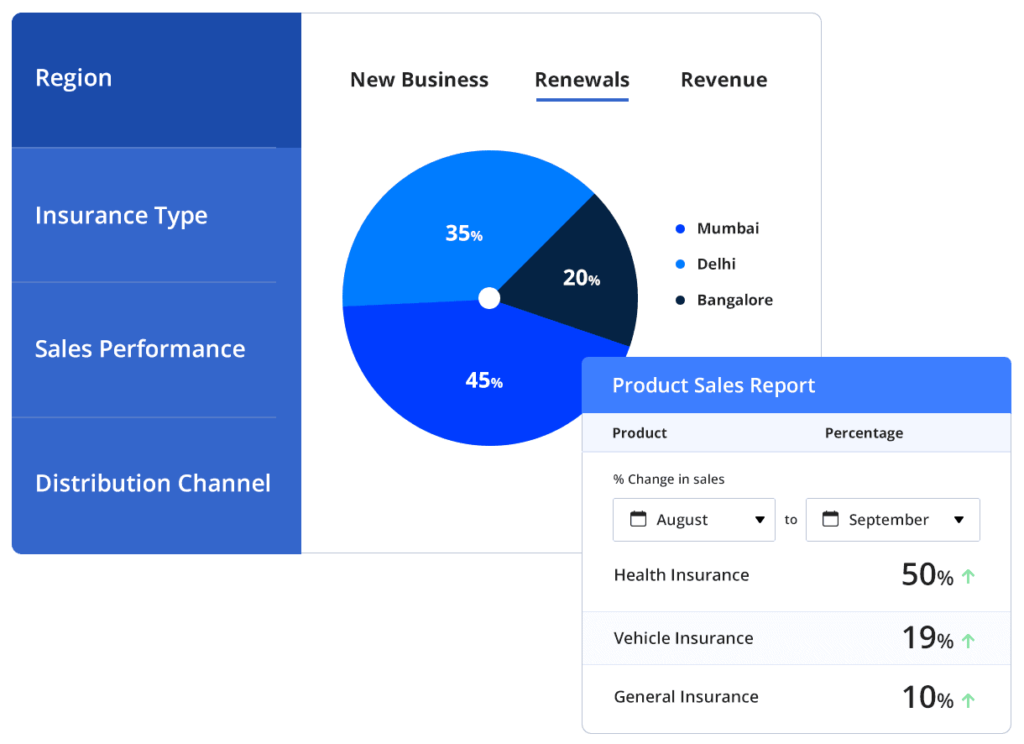

Complete performance reports for your products, teams, agents and more

Reduce borrower acquisition costs and increase operational efficiency

Pre-screening automation allows us to reject unqualified applications at the very start. This has improved our core funnel quality by 60–70%, ensuring only high-quality cases reach underwriting and preventing bandwidth overload.

By automating pre-screening, we eliminate low-quality files early in the process. As a result, our funnel quality has improved by nearly 70%, and underwriting teams now focus only on genuine, eligible cases.