Smart. Scalable. Built for modern financial institutions

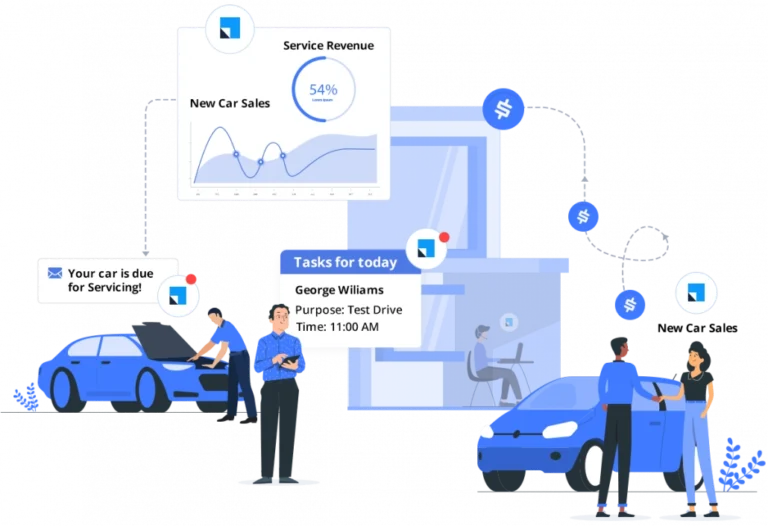

Drive faster sales while maintaining compliance and delivering outstanding customer experiences through AI-led automation

Trusted by India’s Leading Financial Institutions

Unlock growth across

the BFSI spectrum

Tailored solutions for your specific workflows.

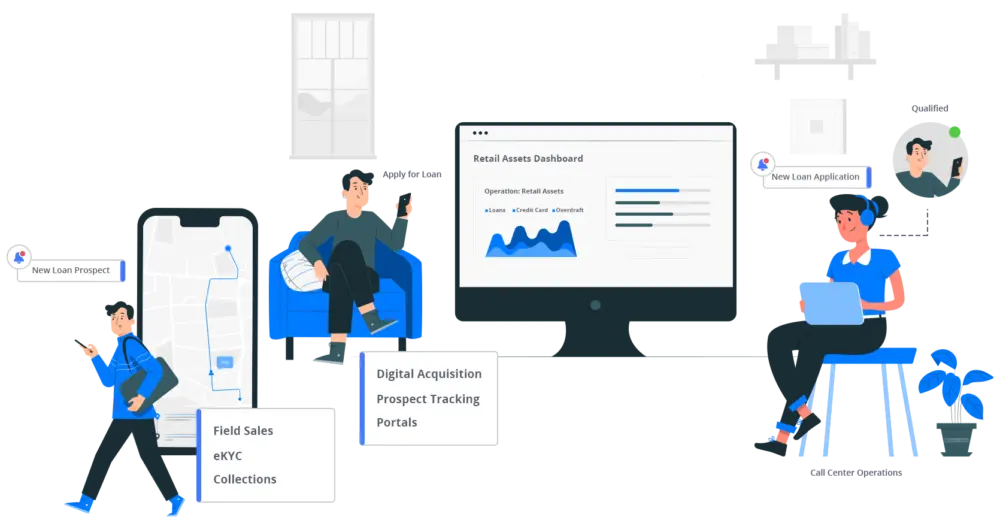

Lending

WPSCRM is a smart, end-to-end lending CRM designed for banks, NBFCs, and financial institutions to manage the complete loan lifecycle. From lead capture and borrower onboarding to underwriting, approval, disbursal, and post-disbursal engagement, WPSCRM automates processes, improves efficiency, and ensures compliance.

Insurance

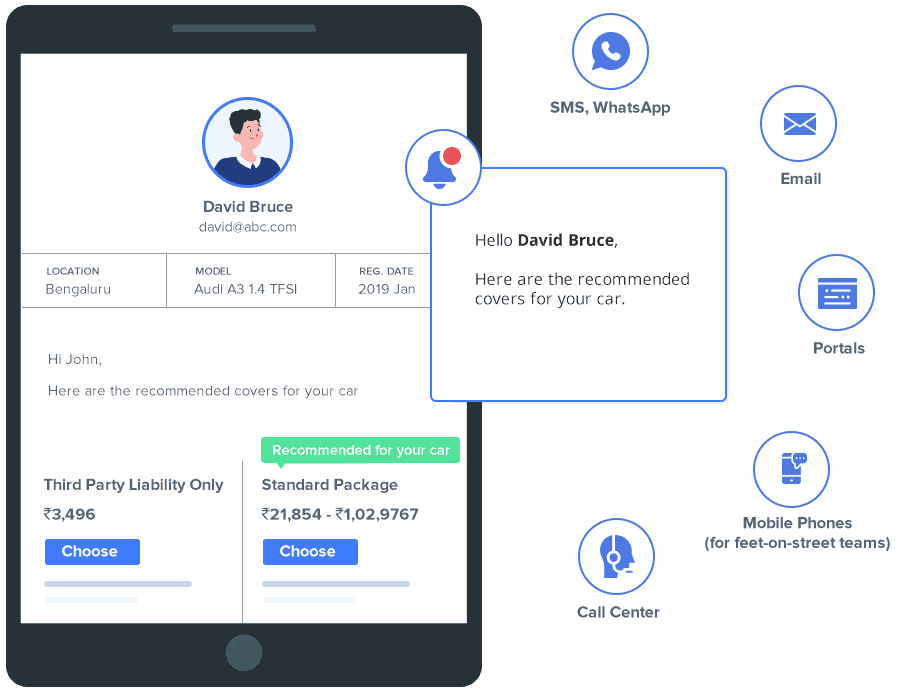

Insurance is a risk management solution that offers financial coverage and peace of mind by protecting individuals and organizations against unforeseen events such as accidents, health issues, property damage, or financial losses.

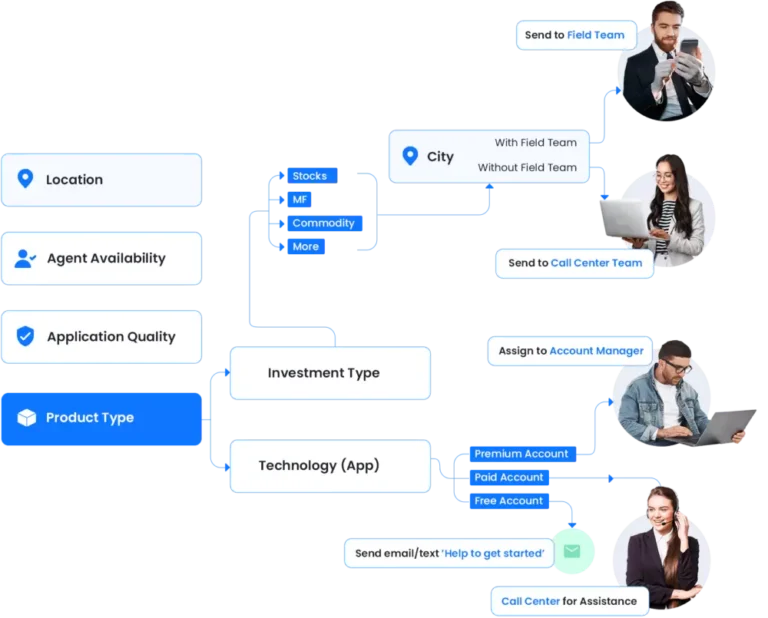

Broking

Broking involves facilitating the buying and selling of financial instruments such as stocks, bonds, and commodities on behalf of clients, ensuring transparency, compliance, and efficient trade execution.

Fintech

FinTech refers to the integration of advanced technology into financial services to improve efficiency, transparency, security, and customer experience across payments, lending, insurance, and investments.

Banking

Banking services enable individuals and organizations to save, borrow, invest, and transact securely through regulated financial institutions, ensuring trust, stability, and economic growth.

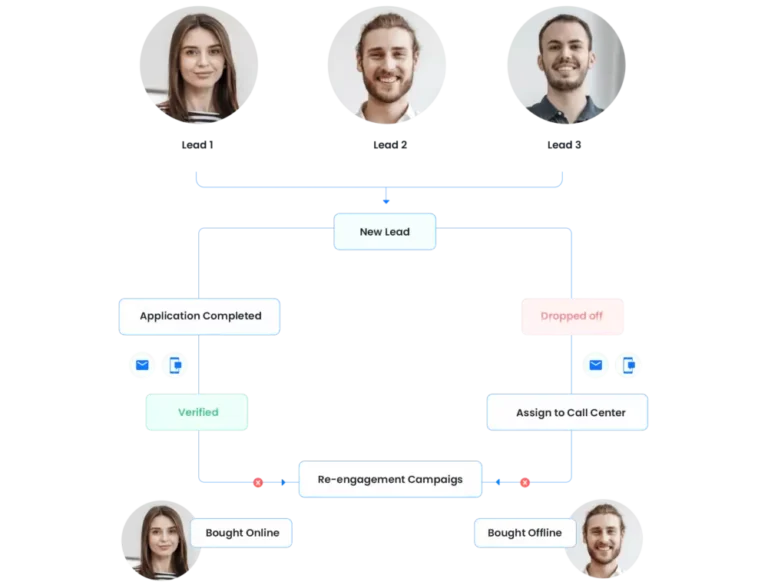

Turn challenges into outcomes

and customer delight

Lead with confidence through a system that unites

your people, processes, and products.

Slash processing times

Seamless collaboration at scale

Stay compliant, stay confident

Strategies, tools, and

insights to scale

How Do You Maximize ROI in Financial..

The Purpose of services

Emerging Digital Technology Trends in Financial Services

A Guide to Business Process Management in Financial Services

Driving Agent Productivity in BFSI with Integrated CRM +..

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Conversational CX: The key to acing the financial services

Customer experience is everything today. Irrespective of how diverse products and solutions.

Grow Like A Pro: Sales Lessons from FinTech Leaders

This webinar teaches how to set clear goals that shape behavior and drive revenue according to your business..

Frequently asked questions

What makes WPSCRM a good fit for financial services businesses?

How does WPSCRM integrate with core banking, LOS/LMS, or trading systems?

Is WPSCRM compliant with financial industry regulations?

What kind of analytics and reporting does WPSCRM offer?

How does WPSCRM support digital onboarding?

Can WPSCRM help reduce loan processing turnaround times?

Can WPSCRM improve agent or advisor productivity?

Does WPSCRM support multi-channel engagement?

Is WPSCRM scalable for large teams or multi-location operations?

How long does it take to implement WPSCRM for a BFSI organization?

Legacy tech can’t drive growth

Outdated and siloed systems are costing you efficiency and customer experience.

Let’s change that.