New Age Lending CRM to Disburse Loans Faster

Your one-stop solution to manage all your processes and teams – Sales, Call Center, Field Sales, Collections and more

TRANSFORMING SALES FOR 2000+ BUSINESSES WORLDWIDE

Make borrowing easy & straightforward for loan applicants

User-friendly application forms, automated back-end processing and more

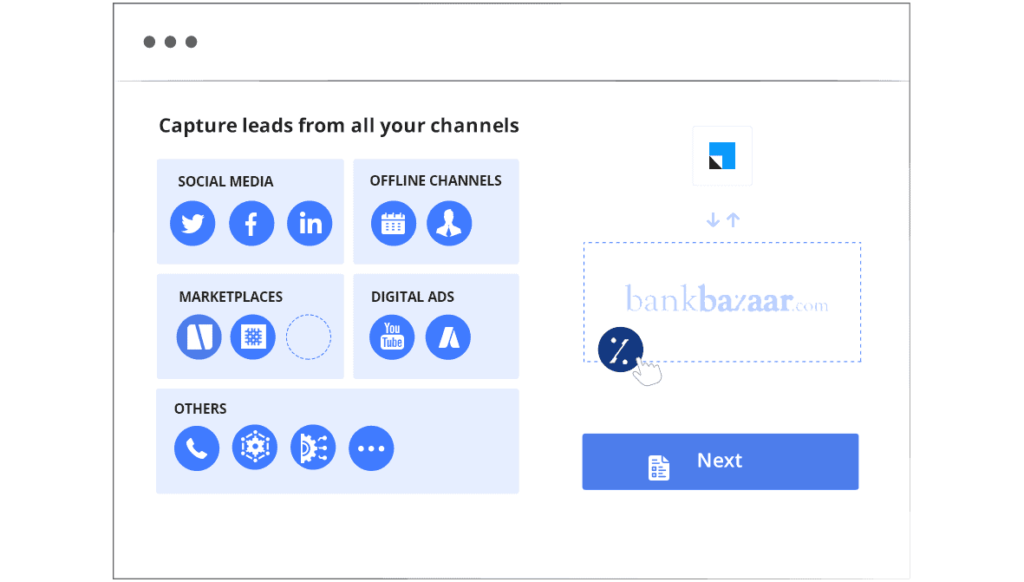

Complete loan inquiry capture

Attract high-quality borrowers faster than your competition. Capture leads from all your channels – digital, phone calls, email, social media, lending marketplaces, and more. With automated screening at each step, your team will never waste a moment on non-serious borrowers or low-quality inquiries.

Self-serve application forms

User-friendly, mobile-optimized forms ensure a smooth application experience for the borrowers. OTP verification helps junk non-serious requests right at the first step. The application can be resumed anytime, thereby enhancing borrower experience and saving the agents’ time.

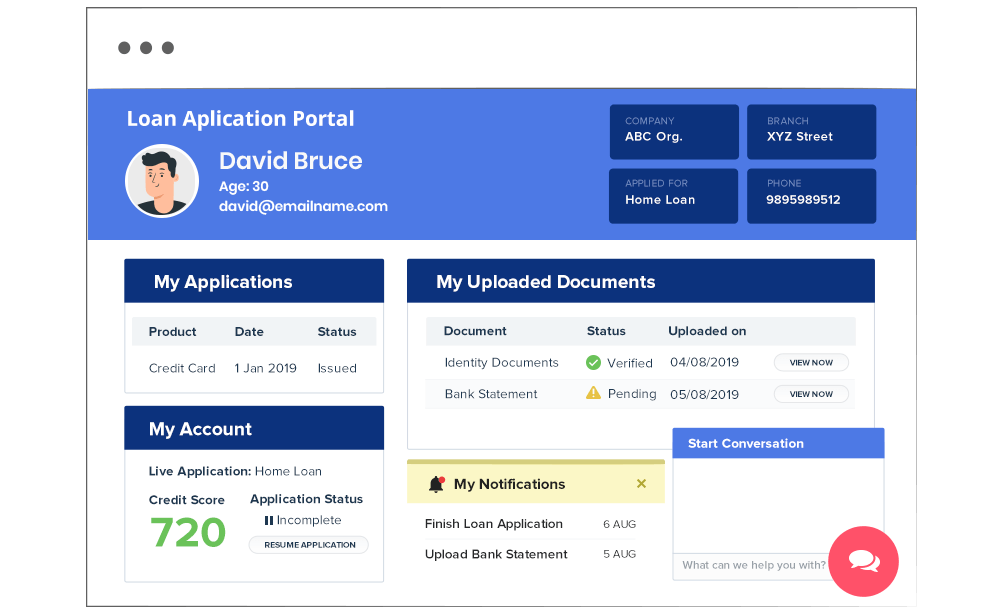

Self-serve lending portals

Give your loan applicants and customers their own application portals. The borrowers can easy-apply for loans, manage their profile & applications, upload documents, check application status and receive verification & approval notifications.

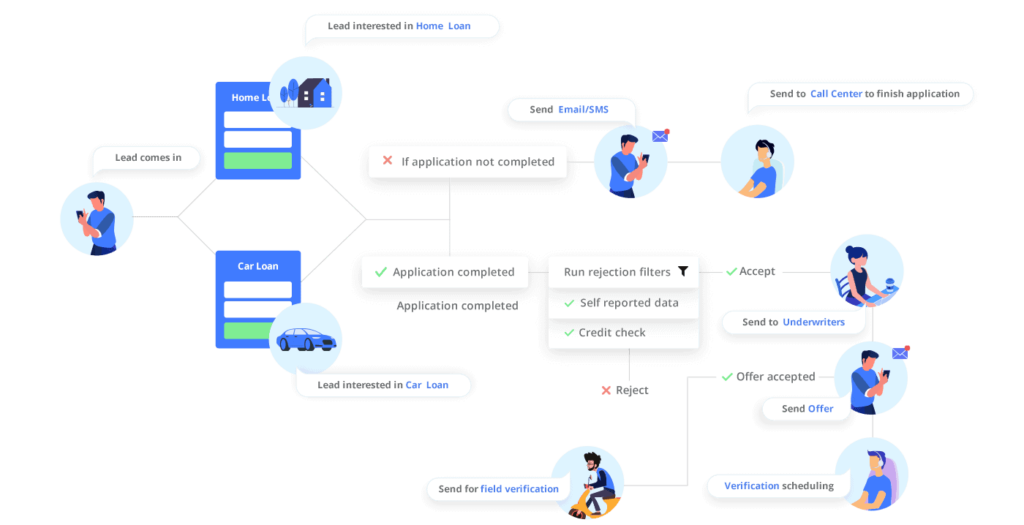

End-to-end loan application management with Process Designer

Provide a seamless digital experience to your teams with loan application workflows

Improve the efficiency of your pre-screening, sales & underwriting teams

Preserve your teams’ bandwidth against redundant tasks

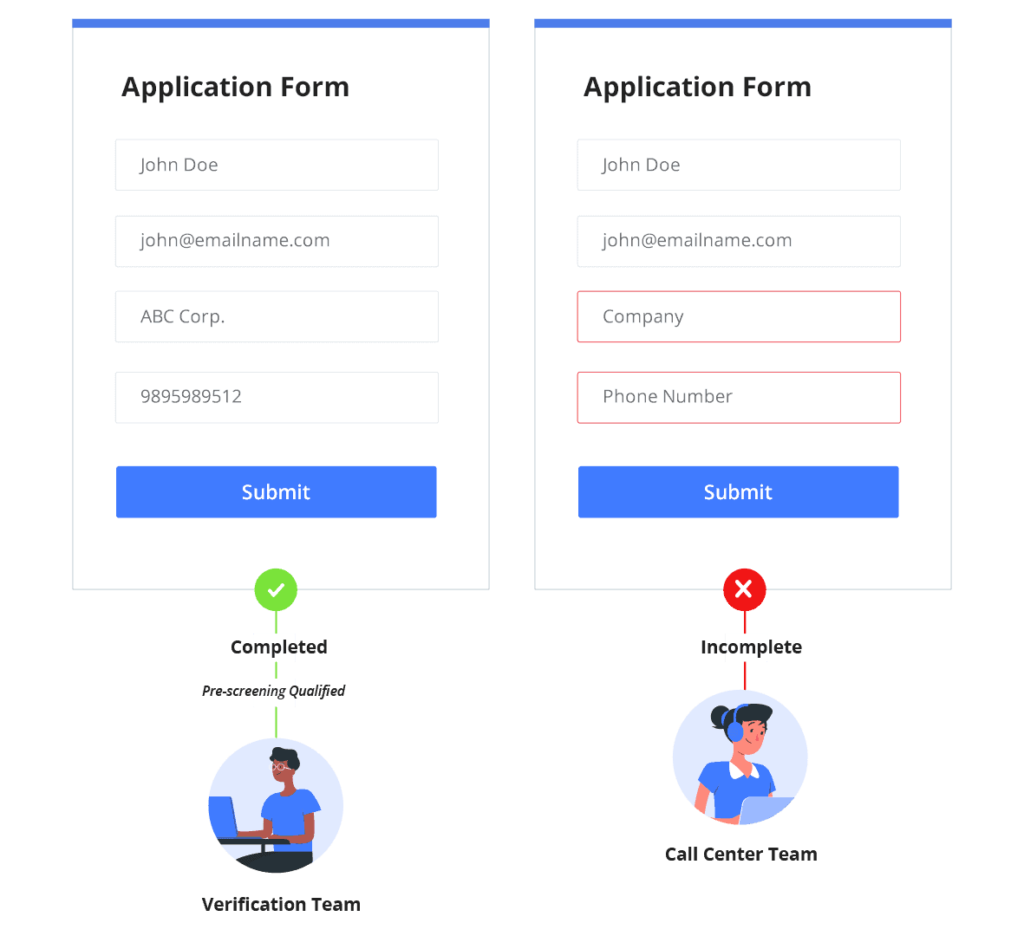

Automated pre-screening checks

Make sure only high-quality applications enter the funnel with pre-screening checks – OTP verification, credit checks, etc. (via integrations with LOS & other tools). This saves your team’s time, improves funnel quality & speeds up loan disbursals.

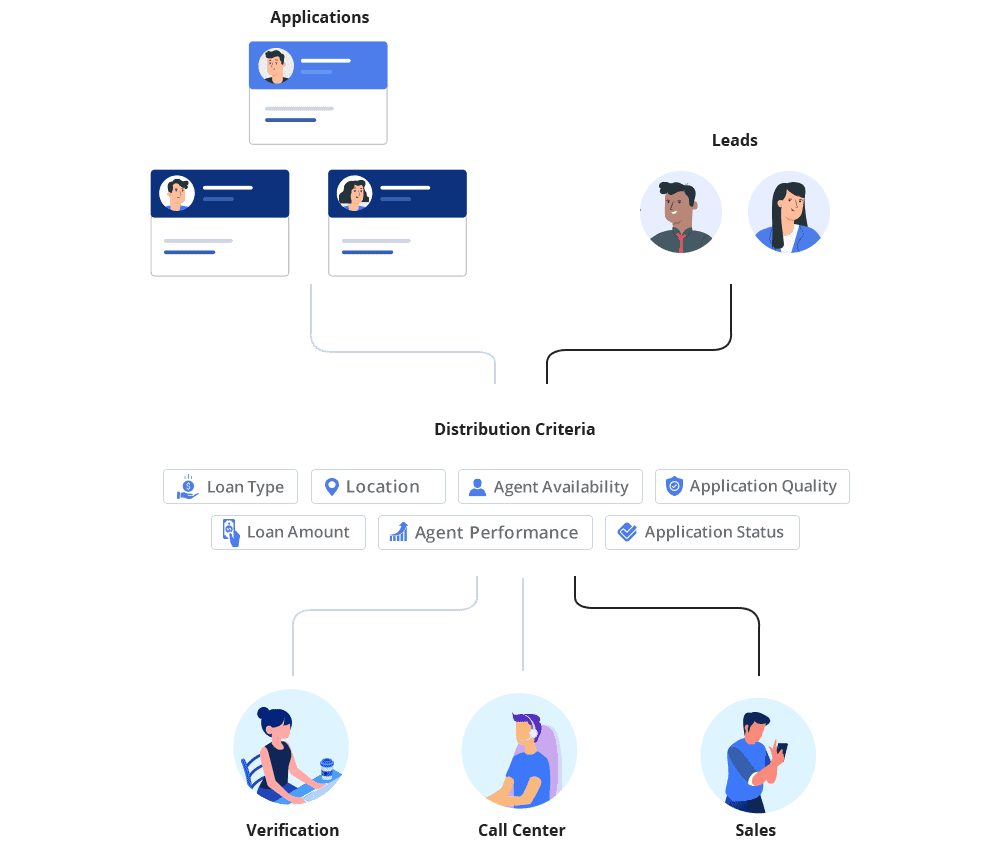

Smart application distribution

Distribute inquiries and applications automatically to your salespeople, underwriters, fraud control, verification & other teams, based on any criteria you want – loan type, location, agent availability, performance, application status and more.

Timely call center intervention

An efficient call center team is the backbone of any lending organization handling large application volume. Preserve your call center bandwidth against junk leads and redundant tasks. Route only those inquiries to call center that don’t close online

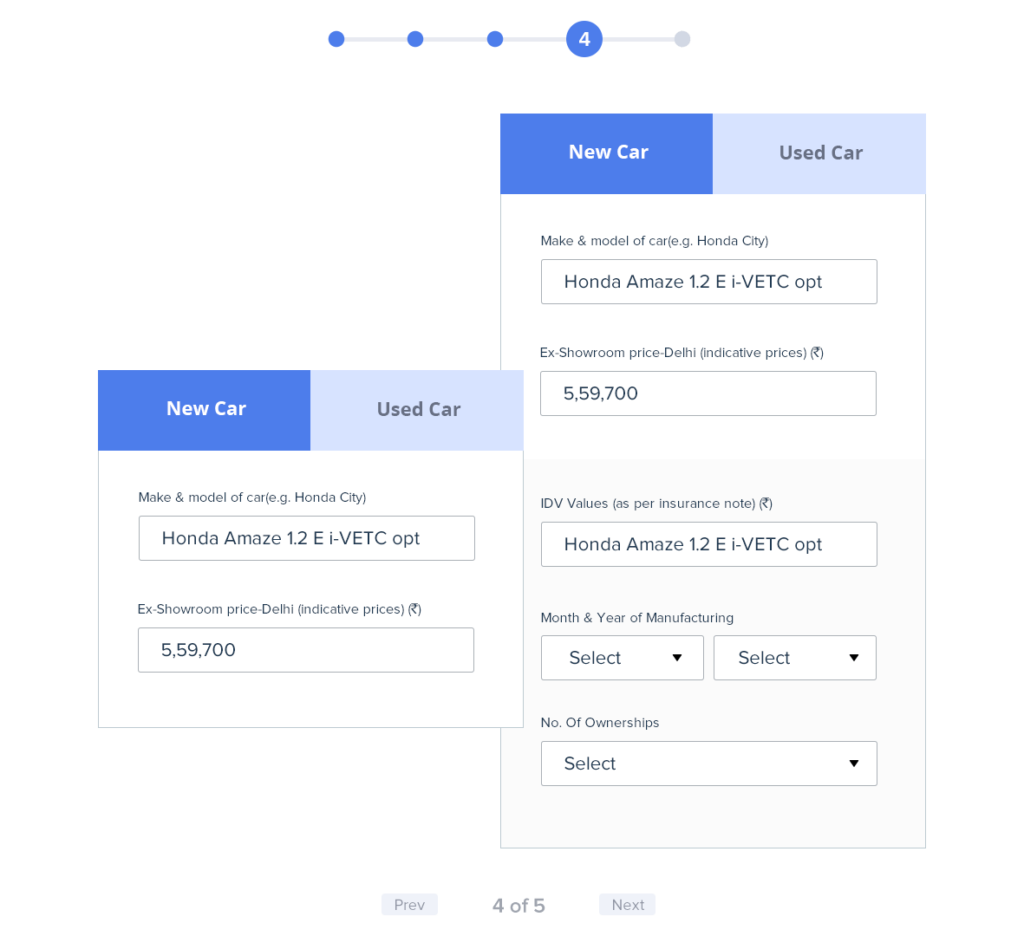

Dynamic forms for your teams

Dynamic forms simplify your teams’ tasks by displaying only the fields necessary for a particular loan application type. It gives your team a clutter-free experience when they fill applications on a borrower’s behalf, reduces the chances of manual error and speeds up the application completion.

Build lasting relationships with borrowers and customers

Build engagement workflows to engage and enroll more borrowers

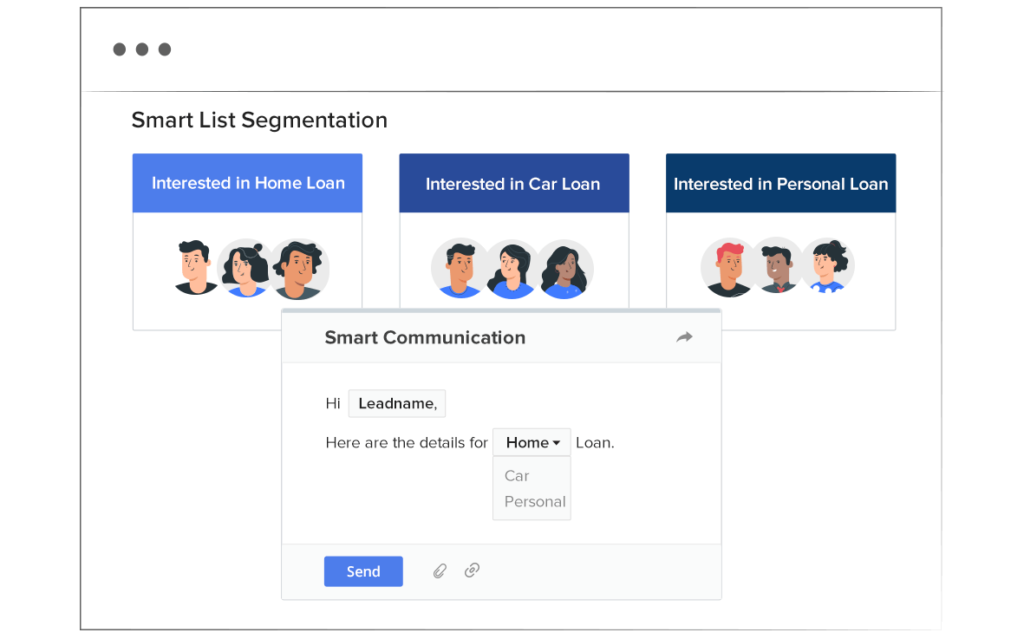

Smart borrower segmentation + relevant communication

Segment your prospective borrowers and customers based on various factors – loans they have applied for, the status of their applications, demographics, location, financial status, credit history and more. Use this information to always maintain relevant messaging across all communication channels.

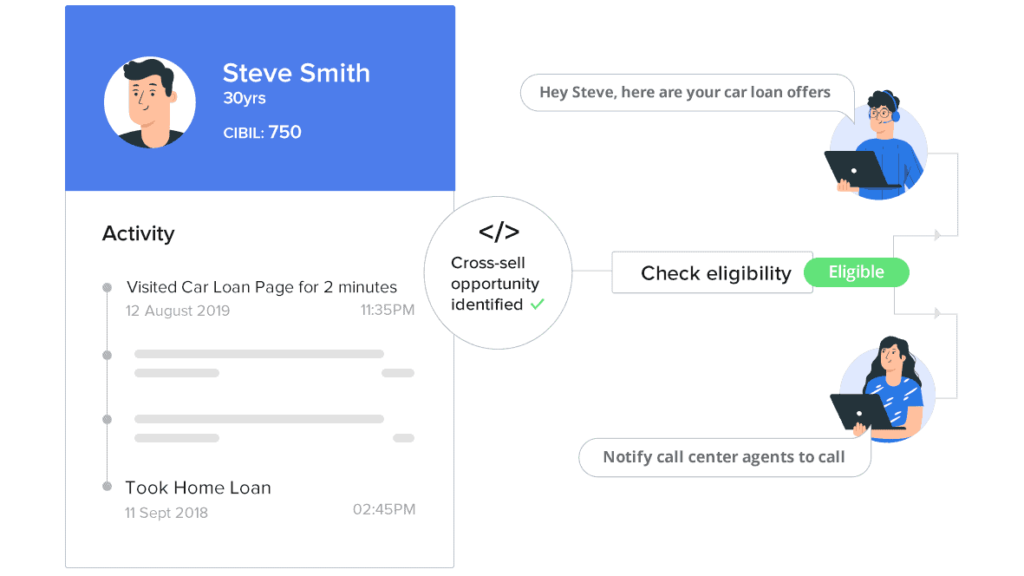

Cross-sell opportunity identification

Increase Customer Lifetime Value and Borrower Retention Rates by identifying and acting upon cross-selling opportunities. For example, a home loan customer with an excellent credit repayment history who visits car loan page on your website can be offered a pre-approved vehicle loan.

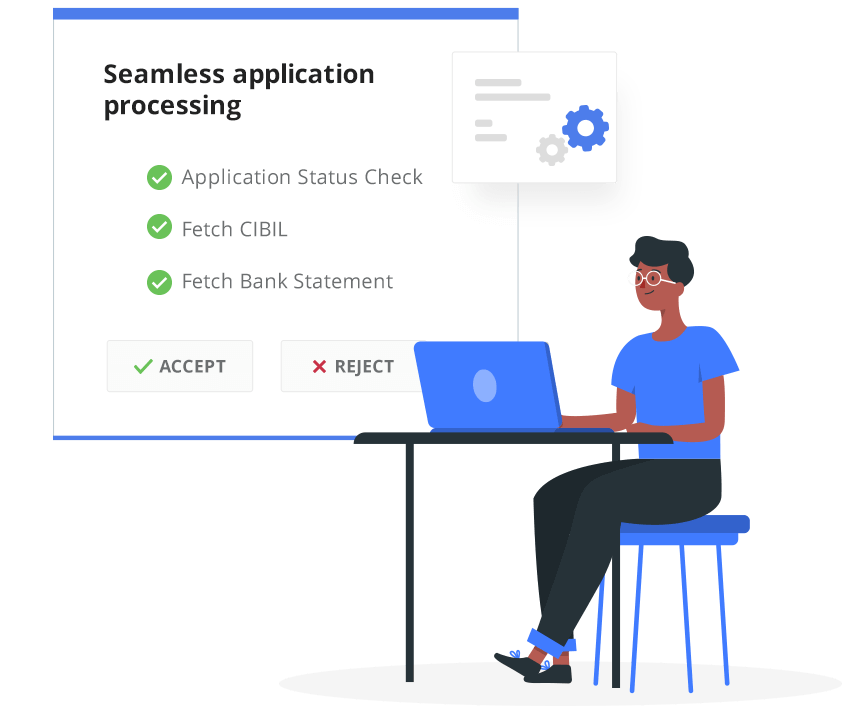

Automate loan offer generation to expedite loan disbursal

By securely accessing relevant data from Loan Origination System and other tools

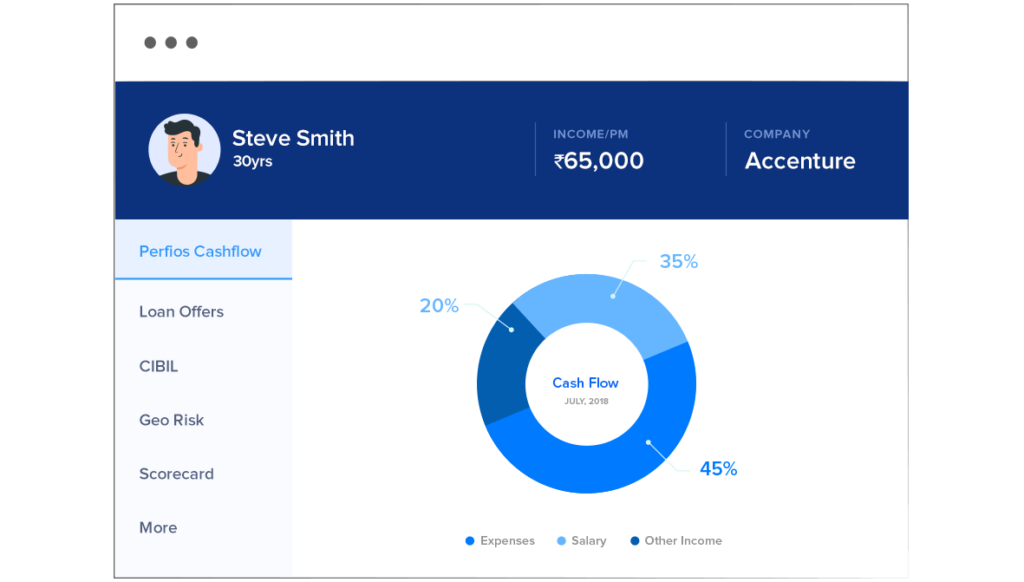

Access borrower info from multiple data points

Use pre-built integrations and data exchange APIs to access all the information you need for loan offer generation. Access data from LOS, CIBIL, Experian Hunter, Perfios, NetBanking Connect, PDF Statement Analyzer, and others. Use this to automate borrower qualification & offer generation.

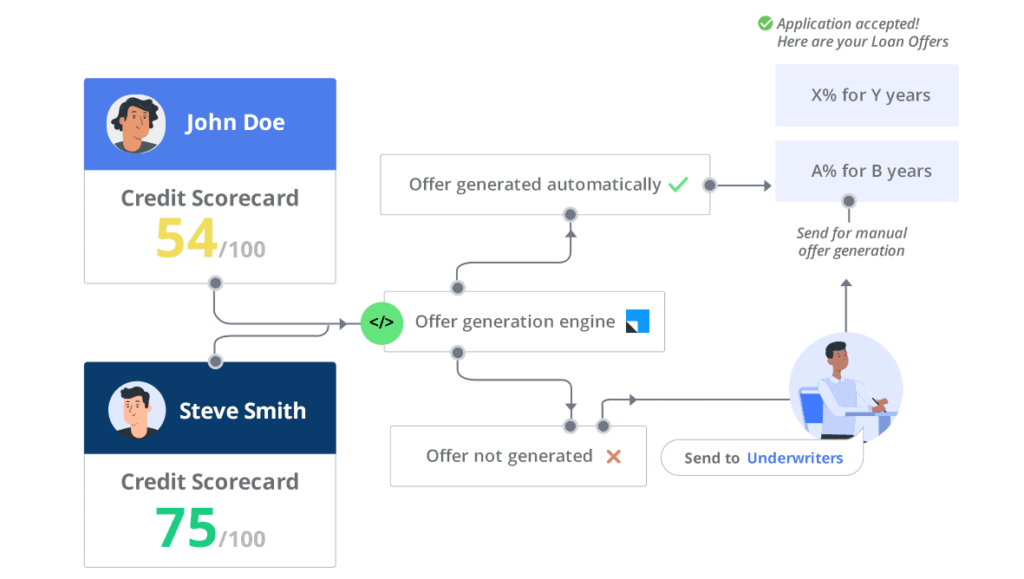

Offer generation engine

Details like income, age, CIBIL scores, and other attributes can be used to generate offers instantly. The attributes can be user-provided or captured through activity tracking (directly in LeadSquared) or accessed from 3rd party tools (via APIs). Reject applications or generate offers based on this.

Build a highly productive field workforce

One mobile app to increase the efficiency of all your feet-on-street teams

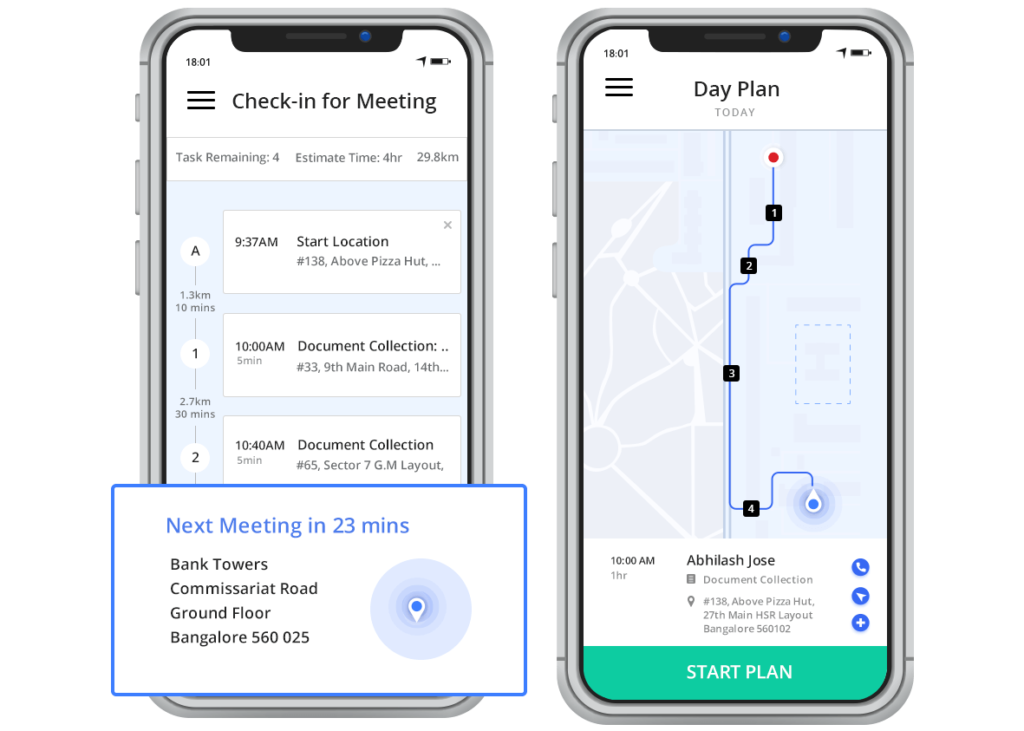

Agents’ daily schedule

WPSCRM automatically plans your agents’ day, including meetings in order of priority, best routes to follow, goals for the day, and more. Increase your team’s productivity by auto-identifying possible meetings in their proximity.

Real-time agent tracking

Don’t let your teams slack by tracking everything they do. There’s auto check-in for agents, geo-tracking to validate meetings, geofencing to ensure no meeting is misrepresented, and tracking of all the conversations and activities.

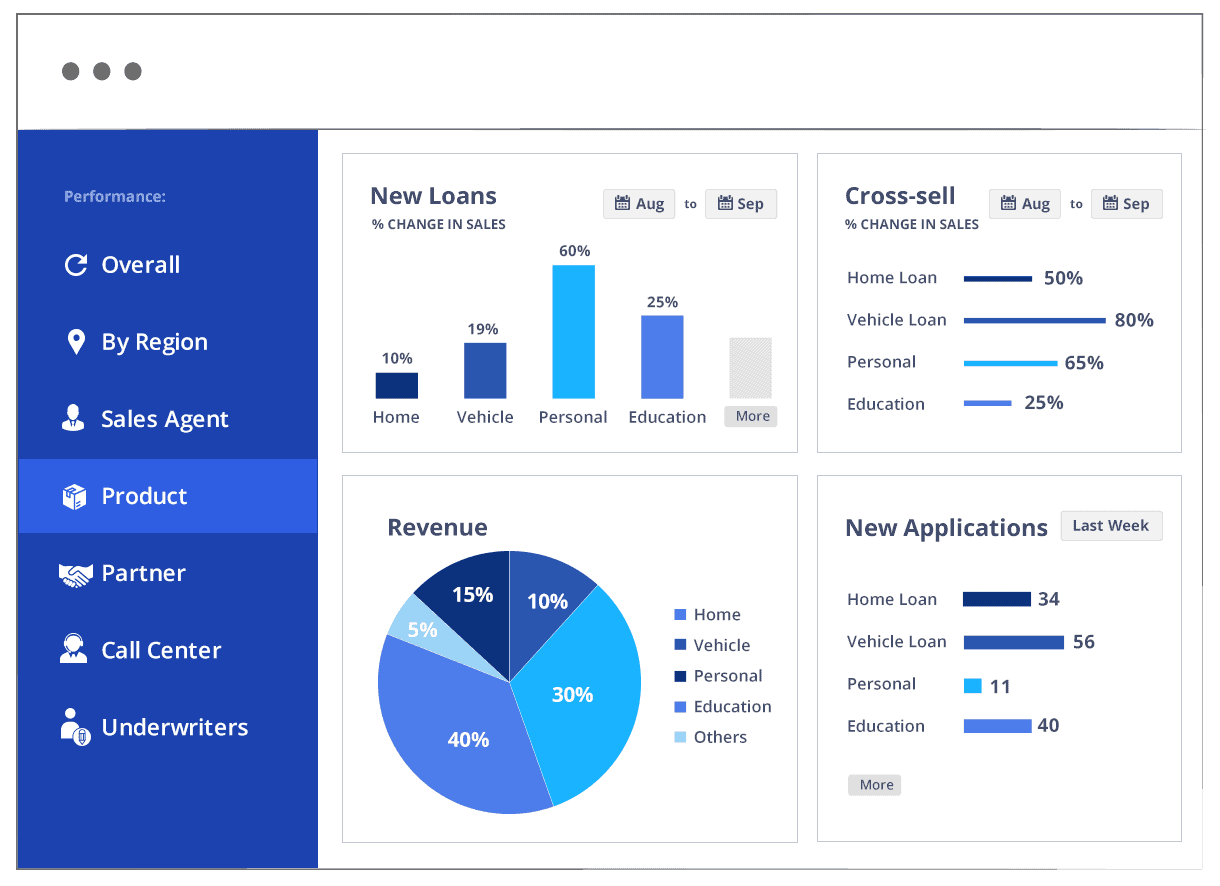

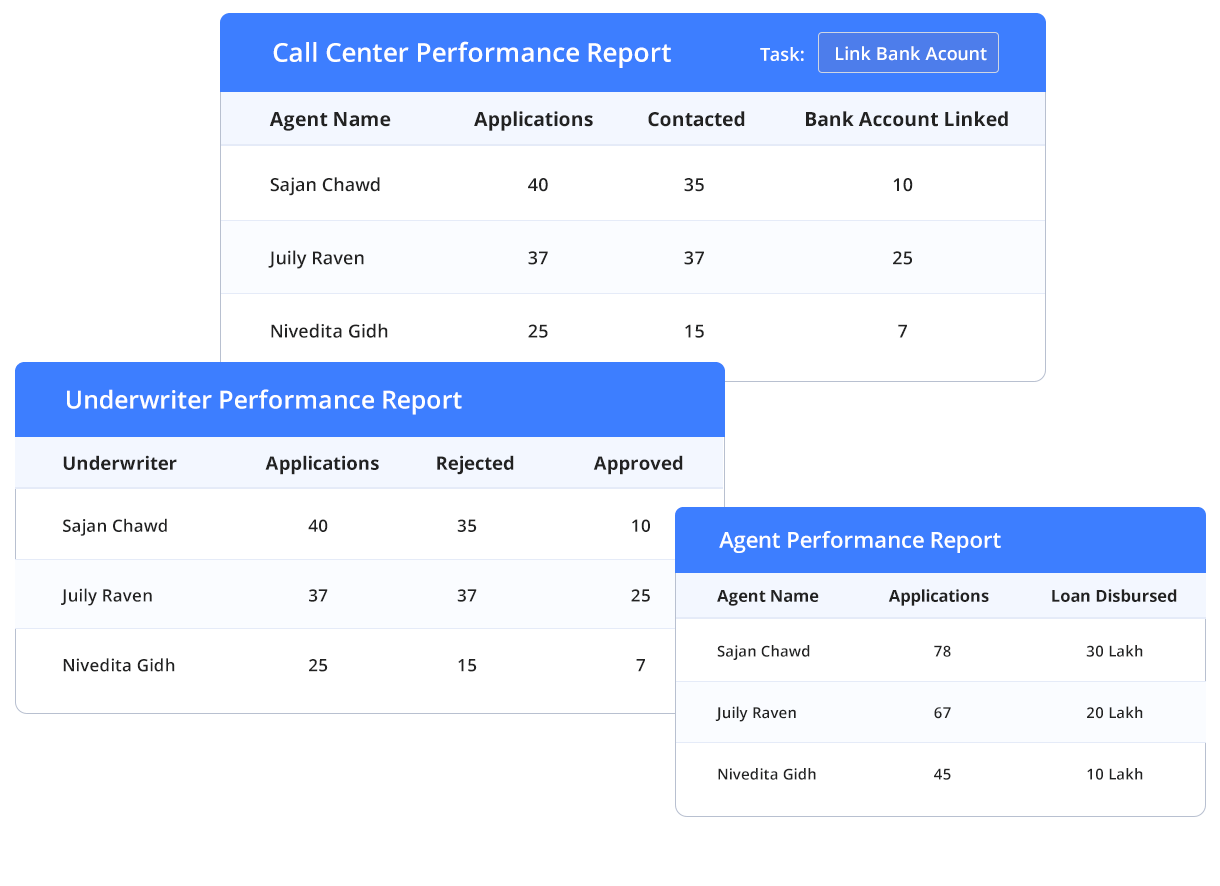

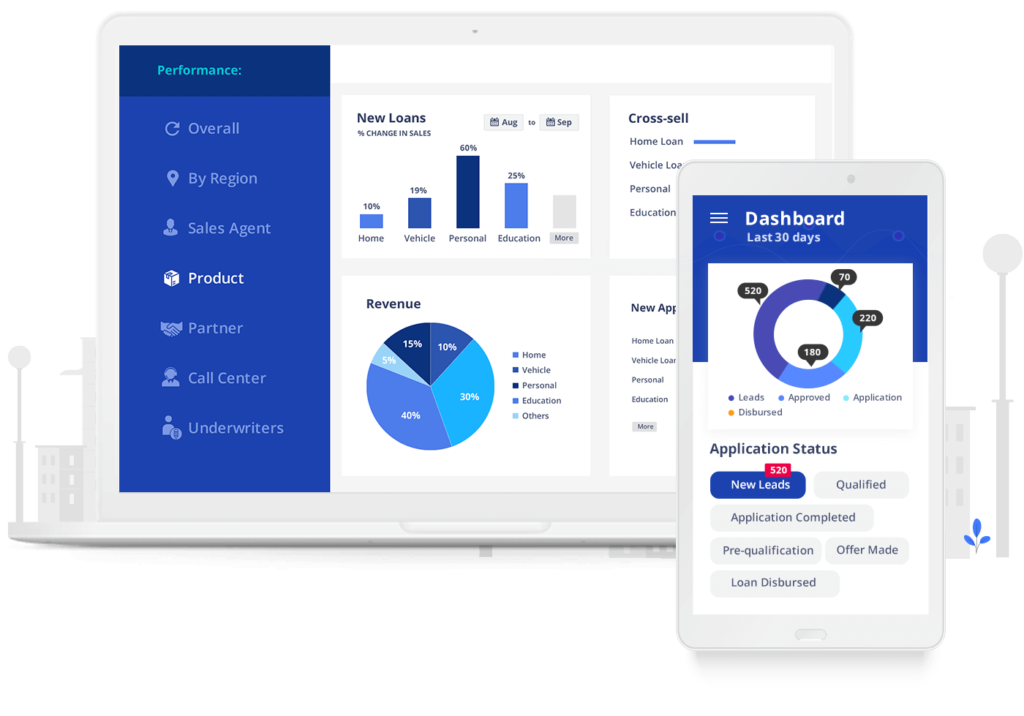

Complete performance reports for your products, teams, agents and more

Reduce borrower acquisition costs and increase operational efficiency