Loan Origination System for a Frictionless Borrower Experience

Leverage wpscrm WhatsApp Lending Bot, right from lead capture, to pushing loan applications by integrating with any Loan Origination System. Process loans faster on WhatsApp!

Enabling Digital Lending for Businesses Worldwide

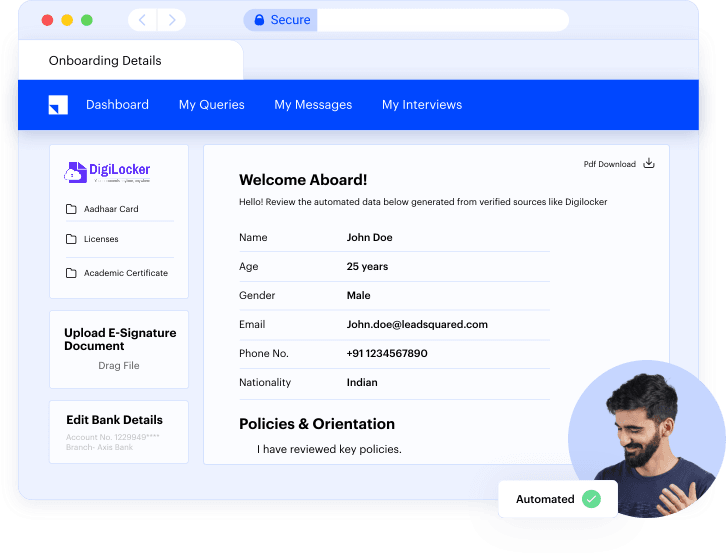

Automate End-to-end Customer Onboarding

- Enable zero manual data entry with KYC OCR, ML-based image recognition, and automated data fetch from verified sources like Digilocker.

- Setup knockout rules to automatically filter ineligible loan applications and simplify decisioning.

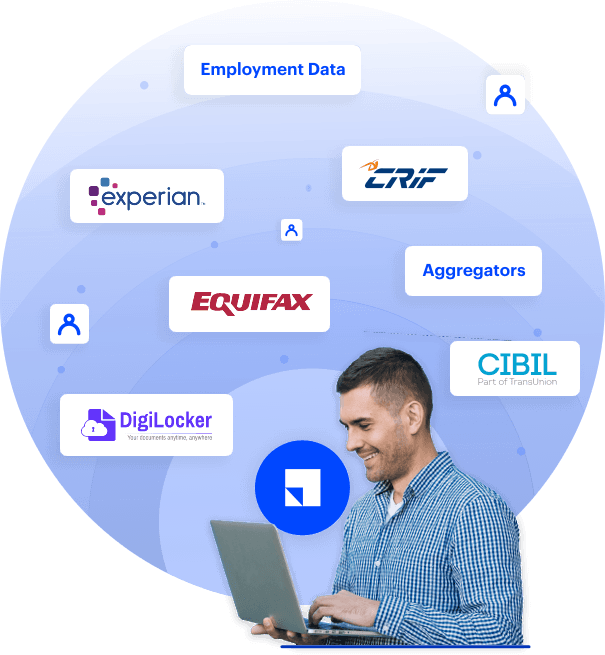

Ensure Super-fast Loan Sanction!

- Tap into ready integrations with credit bureaus and account aggregators for rich underwriting data.

- Reduce underwriting TAT by automating processes for field investigation and RCU (Risk Containment Unit).

- Enable fraud detection via external negative lists & internal databases.

Digitize Data Collection and Management

- Account aggregators

- Bureau data (CIBIL, Experian, Equifax & CRIF Highmark)

- Digilocker data

- Employment data, and more!

Be Compliance Ready!

- Monitor & control credit risk in compliance with the dynamic regulatory environment.

- Employ an RBI compliant multi-purpose customer consent capture mechanism.